Crypto can be a wild ride, but BingX just buckled up with $150 million in safety gear. Fresh off a $42 million hack, the exchange has fired back with a permanent Shield Fund aimed at protecting users from future hits.

In a nutshell:

- BingX introduces a $150M Shield Fund for 24/7 user protection.

- The fund follows a $42M hack and $5M USDT airdrop.

- Combines with Proof-of-Reserve to boost transparency and trust.

BingX Steps Up with a Game-Changing $150M Shield Fund

BingX just dropped big news: it’s launching the Shield Fund, a self-funded $150 million reserve created to guard users against technical failures, hacks, cyberattacks, and other ugly surprises. Unlike typical crypto insurance, this fund doesn’t wait around. It’s live. Always.

The Shield Fund isn’t just money sitting around. It’s actively monitored with constant audits and risk checks to keep it sharp. Built to last, it promises real-time protection for every BingX user.

According to Vivien Lin, Chief Product Officer at BingX, “This isn’t just a safeguard. It’s how we show up for our users—responsibly and at scale.”

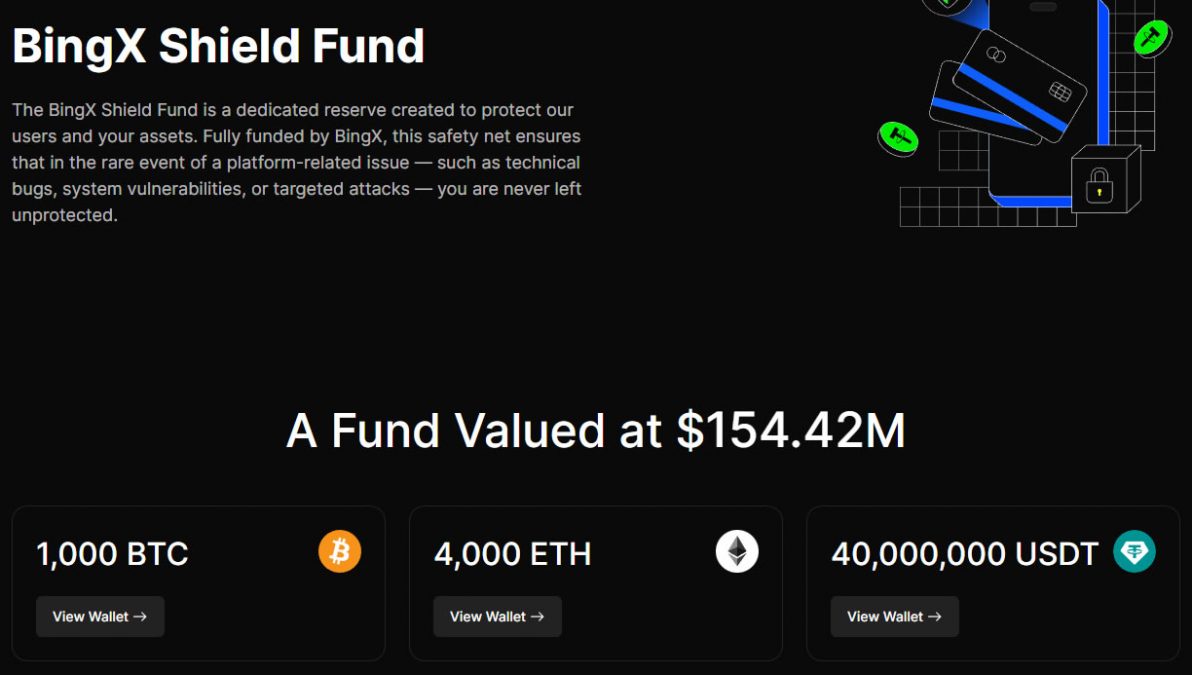

The insurance fund consists of 1,000 Bitcoin, 4,000 Ethereum, and $40 million USDT. Because it consists of crypto assets, the fund’s exact value will fluctuate. To see current value, you can always visit BingX’s Shield Fund page.

Why Now? A $42 Million Wake-Up Call

Let’s rewind. In September 2024, BingX joined a string of exchanges that got hit in a wave of crypto hacks. A hot wallet breach drained over $42 million from the platform. But here’s the twist: BingX didn’t flinch.

BingX was hacked, losing over $42 million in assets, adding to a series of crypto breaches. The exchange promises full compensation, quick withdrawals, and stronger security.Read Now

They reassured users immediately. Full compensation. Quick withdrawal resumption. And a $5 million USDT airdrop to show gratitude.

The Shield Fund is the follow-up punch. It’s not just damage control, it’s defense in depth.

More Than Just Talk: Proof-of-Reserve + Shield Fund

This isn’t BingX’s first play in the security game. They’ve already rolled out Proof-of-Reserve to show users their assets are actually there. The Shield Fund adds another layer of trust, locking in a powerful combination of transparency and protection.

Together, these tools aim to prevent future disasters, or at the very least, make sure users aren’t left holding empty bags.

How Does It Stack Up?

BingX joins a select club of exchanges with serious safety nets:

- Binance leads with a $1 billion insurance fund.

- Bitget isn’t far behind with over $500 million.

- MEXC has a solid $470 million.

BingX’s $150 million Shield Fund might not be the biggest, but it’s among the boldest, especially considering the timing and the fact it’s entirely self-funded.

What’s Next for Traders?

The crypto space has trust issues, and for good reason. Hacks happen. Promises get broken. But BingX is trying to flip the script. By combining transparent reserves with an always-on safety net, it’s aiming to be more than just another exchange. It’s pitching itself as a platform built for long-term trust.

If you’re trading on BingX, here’s what this means:

- Your funds have a permanent, real-time safety buffer.

- You get clearer insight into platform reserves.

- You’re backed by systems that are built to respond, not just react.

In a crypto world full of rug pulls and flash hacks, proactive protection matters. BingX is betting $150 million that you’ll agree.

Ready to trade with added peace of mind? Check out BingX’s Shield Fund details, see how your assets are protected, and trade smarter today.