We had a great set of developments on major crypto exchanges this week, and it’s not even over yet. Here’s a roundup of this week’s most exciting developments in the crypto world. From major partnerships to groundbreaking features, here’s what’s shaping the future of digital assets.

Key Takeaways:

- Crypto.com is partnering with largest German banking institution Deutsche Bank.

- Gate.io introduces Gate Pay, a customizable payment solution to help businesses embrace Web 3.0 seamlessly.

- Circle and Binance partner to expand USDC adoption, integrating stablecoins into global financial systems.

- Bitget prepares for MiCA compliance by setting up shop in Lithuania.

- Phemex launches Trading Data for real-time market insights, helping users optimize their trading strategies.

- BloFin collaborates with Insilico Terminal to revolutionize professional trading with powerful tools and automation.

Crypto.com and Deutsche Bank Forge a Game-Changing Partnership

Crypto.com has partnered1 with Deutsche Bank – the largest German banking institution – to provide corporate banking services in Singapore, Australia, and Hong Kong. This collaboration enhances Crypto.com’s financial operations and establishes a robust foundation for its business in the Asia-Pacific region.

This partnership marks a milestone for Crypto.com, as the exchange continues to emphasize security, compliance, and operational efficiency. Karl Mohan, Crypto.com’s General Manager for APAC and MEA, expressed excitement about teaming up with a global banking leader like Deutsche Bank. Deutsche Bank’s Kriti Jain highlighted the bank’s commitment to supporting innovative businesses like Crypto.com, emphasizing the bank’s strong track record with new economy clients.

This announcement follows Crypto.com’s recent rollout of its 2025 product roadmap and its launch of “Level Up,” the platform’s most comprehensive rewards program. A couple of days ago, Crypto.com acquired a brokerage company in Abu Dhabi2, growing their presence in the United Arab Emirates. This partnership will enable them to offer a wide range of financial products to customers, including securities, options, futures, CFDs and more.

Company has been on a buying spree recently, acquiring an Australian-licensed broker, alongside several other companies. With the backing of Deutsche Bank, Crypto.com is poised to expand its services and cement its position as a leader in the crypto space.

Gate Pay Launches White-Label Crypto Payment Solution

Gate Pay unveiled3 a new White-Label Cryptocurrency Payment Solution to empower businesses in the Web 3.0 era. This solution enables companies to implement branded crypto payment systems quickly and cost-effectively, addressing the growing demand for seamless and secure payment options in the decentralized space.

Key features of this tool include customizable payment interfaces, secure closed-loop payment flows, and sub-account management for better operational control. Gate Pay also provides smart accounting and reporting tools, offering real-time insights into transaction data. Businesses with minimal technical expertise can integrate this solution effortlessly, making it highly accessible.

Gate Pay’s innovation aims to accelerate Web 3.0 adoption, allowing businesses worldwide to leverage cryptocurrency payments with ease. By lowering barriers to entry, Gate Pay is setting the stage for widespread adoption of crypto in everyday commerce.

Circle and Binance Team Up to Accelerate USDC Adoption

In a landmark collaboration, Circle and Binance announced4 a strategic partnership to promote USDC stablecoin adoption globally. The partnership, unveiled at Abu Dhabi Finance Week, will integrate USDC into Binance’s products and services, benefiting the platform’s 240 million users.

Binance plans to adopt USDC for its corporate treasury operations and expand the stablecoin’s use cases across trading, payments, and savings. Circle, on its part, will provide Binance with liquidity, technology, and tools to enhance user trust and drive innovation in stablecoins. Jeremy Allaire, CEO of Circle, emphasized the alignment of USDC with Binance’s vision of becoming the world’s leading financial super app.

European MiCA regulations are spelling doom for unregulated stablecoins in Europe, and major crypto exchanges have been looking to provide regulated trading options. As such, Binance’s partnership with Circle is a significant step towards mainstreaming stablecoins, with both companies committed to strengthening the global financial ecosystem and advancing the utility of digital dollars.

Bitget Prepares for MiCA Compliance with EU Expansion

Even more regulatory-related moves are happening, as Bitget is taking steps to comply with the European Union’s Markets in Crypto-Assets (MiCA) framework by establishing a regional hub in Lithuania5. This move aligns with the EU’s vision for a unified regulatory environment for cryptocurrencies and underscores Bitget’s commitment to compliance.

Bitget plans to set up offices in Lithuania, hire compliance professionals, and collaborate with European regulators to ensure all products meet regulatory standards. Already holding licenses in markets like Poland, Italy, and Australia, Bitget has shown consistent efforts to adhere to global regulations.

Last week Bitget launched BitEXC, a local exchange servicing customers from Vietnam, thus expanding their reach in Asia. In November, Bitget started offering regulated crypto trading services in United Kingdom in partnership with Archax.

Bitget just launched a standalone Vietnam crypto exchange BitEXC, tailored for the local market. We took a look at the platform and wrote a review, so find out if BitEXC is good or not.Read Now

With this latest strategic expansion to Lithuania, Bitget is not only preparing for MiCA compliance but also contributing to the growth of Europe’s vibrant crypto ecosystem.

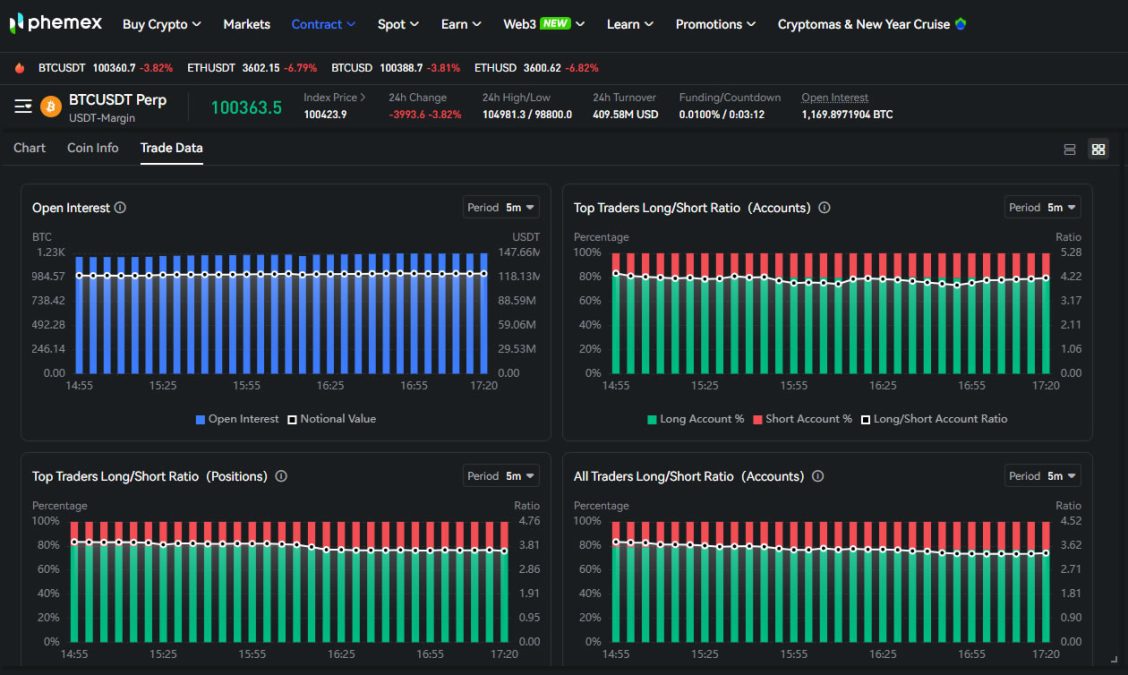

Phemex Rolls Out New Trading Data Feature

Phemex has launched6 a new Trading Data feature to help traders make smarter decisions. This tool provides key market insights, including open interest data, long/short ratios, top traders’ positioning, and funding rate history.

By offering real-time data and transparent reporting, Phemex aims to empower traders to better manage risks and optimize their strategies. Whether it’s identifying market sentiment or analyzing costs in perpetual contracts, the Trading Data feature equips traders with the tools they need to succeed.

Phemex may be a smaller exchange compared to some industry giants, but it has been growing rapidly. In part, this is due to their constant improvements and innovations on the platform. Just days ago, Phemex added Passkey support to improve user account security. This latest feature addition reinforces Phemex’s commitment to providing its users with cutting-edge resources, and establishes it as one of the leading No-KYC crypto exchanges.

BloFin Partners with Insilico Terminal

Phemex isn’t the only smaller no-kyc exchange to keep innovating, because BloFin has teamed up with Insilico Terminal7 to provide professional traders with high-performance tools. Insilico Terminal brings advanced features like Swarm Automation, TWAP, and Depth of Market (DOM) trading to BloFin users, enabling precise strategy execution and portfolio management.

This partnership simplifies the trading process for advanced users, allowing them to integrate Insilico Terminal through API keys. With Insilico Terminal’s speed and efficiency, BloFin traders can now operate with greater control and accuracy.

BloFin begun as a professionals-first platform, catering to experienced traders. It didn’t even launch with a spot trading feature, which was only added earlier this year. Other platform improvements and partnerships throughout the year include the addition of demo trading feature, fiat deposits, and partnerships with TradeStream and Chainalysis for trade journaling and security.

Professional traders will love the easy Insilico integration on BloFin. This partnership makes it even more obvious that BloFin is a serious player in the crypto trading game and worth keeping an eye on.

This week showcased the crypto industry’s relentless innovation and focus on regulatory alignment. These partnerships and features signal exciting developments for traders, businesses, and the broader digital economy.

Stay updated and informed on latest industry news and insights by following Cexfinder on social media!

- Crypto.com Teams up with Deutsche Bank in Banking Milestone ↩︎

- Crypto.com Acquires Orion Principals Limited ↩︎

- Gate Pay Introduces White-Label Cryptocurrency Payment Solution… ↩︎

- Circle and Binance Form a Strategic Partnership ↩︎

- Bitget Prepares for MiCA Compliance ↩︎

- Introducing Our New Trading Data Feature at Phemex ↩︎

- BloFin Partners with Insilico Terminal ↩︎